Oustanding gross debt (excl. lease liabilities)

| Borrowings - 31 December 2022 | Interest rate | Maturity date | Available amount | Drawn | Undrawn | Covenants |

|---|---|---|---|---|---|---|

| Amortizing Term Loan | Floating | Sep-23 | $348m | $348m | $0m | EBITDA interest coverage adj ≥ 4.5x Net Debt / EBITDA adj |

| Totale - HMS Host Corp | $348m | |||||

| Amortizing Term Loan | Floating | Sep-23 | €200m | €200m | €0m | |

| Revolving Credit Facility | Floating | Sep-23 | €500m | €0m | €500m | |

| Total - Autogrill S.p.A. | €200m | €500m |

Based on the nominal value of borrowings as of 31 December 2022

The chart includes committed lines facilities only

On 3 December 2021 the Group completed the refinancing of its overall indebtedness through a 5-year multi-currency, medium-long term cash financing agreement for a maximum total principal amount of one billion euros with a pool of primary banks, and simultaneously early repaid through the full reimbursement (i) the bilateral financing contracts and the financing contract backed by SACE guarantee in place for Autogrill S.p.A. and (ii) the bank loan and the two bonds in place for the subsidiary HMSHost Corporation.

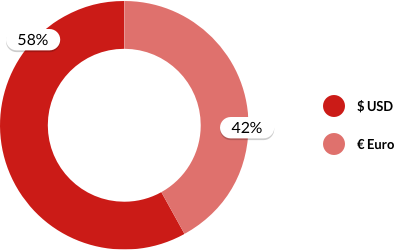

Breakdown by currency

Breakdown by coupon

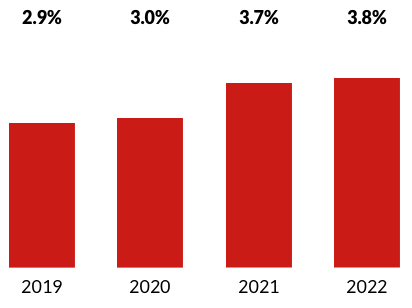

Average cost of debt (1)

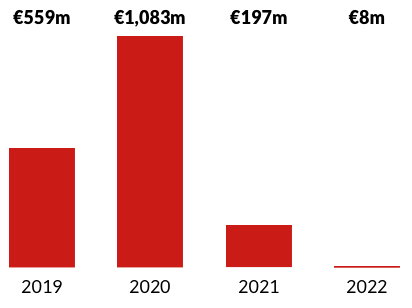

Net financial position

(1) Average cost of debt is calculated on average gross debt outstanding and includes the costs of undrawn credit facilities